4 tips for your start-up business

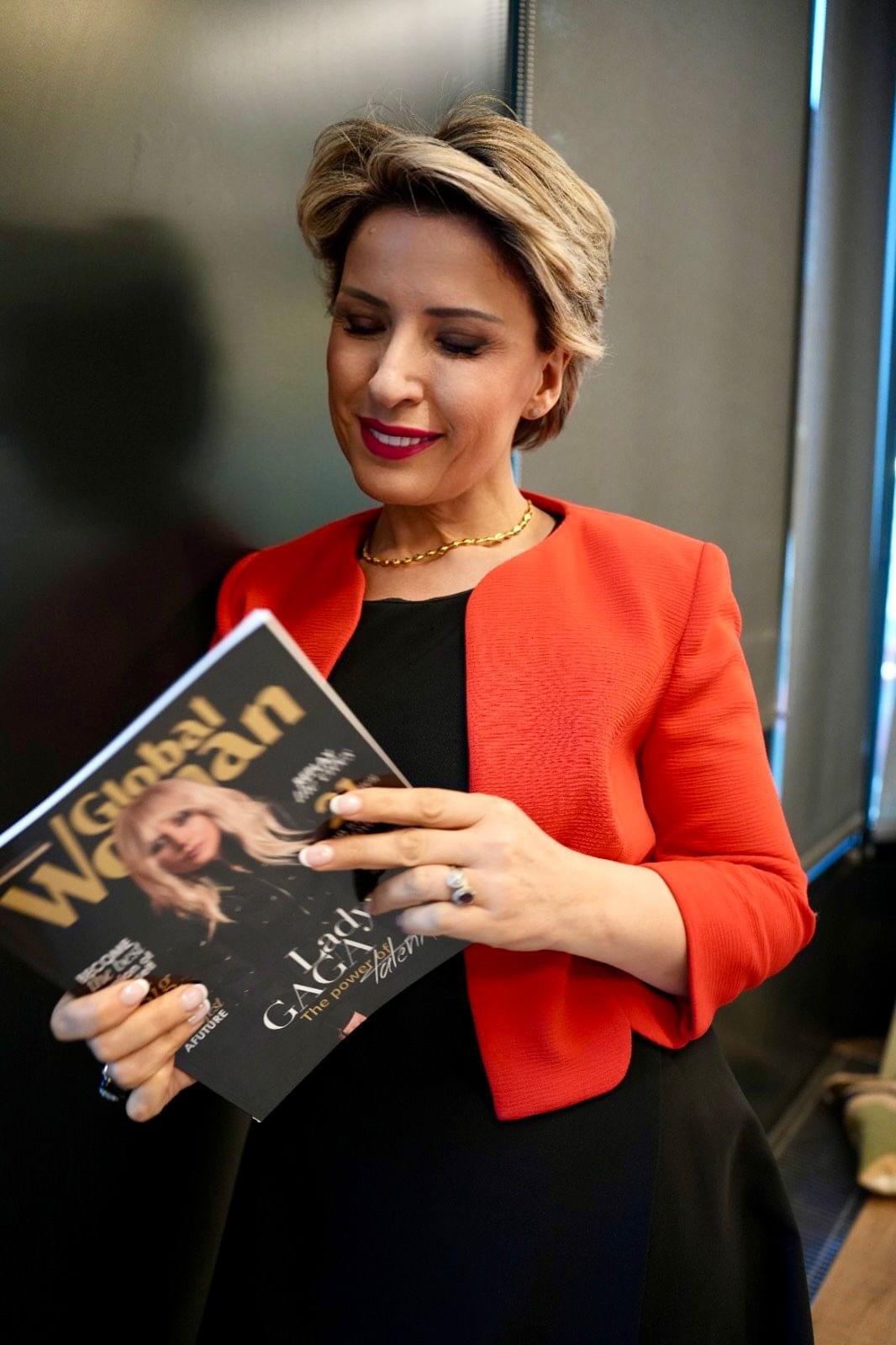

Linda Dajci

Linda has always been motivated by meeting set targets and deadlines, as it gives her a sense of accomplishment with very visible results. As a young girl, she would often help her father with payroll duties, which gave her a taste of real achievement that is still with her today. Later on in life when she got the opportunity to choose a profession of her own, she didn’t hesitate to study accountancy. This was partially down to the fact that she took great comfort in the universal language of numbers. But also, the therapeutic aspect of ‘balancing the books’ gave her peace of mind.

Finding the right balance is crucial for her, in all aspects of life, and it is also a hard lesson to learn that it requires both time and patience. Her company’s services are the core of what goes on in today’s financial market, and keeping up to date with a dynamic economy for her, is an art form of its own. Her satisfaction comes from getting to the heart of a business, learning from their experiences and helping them achieve better.

More and more people are driven to starting up their own business – what should anyone considering this path need to know before contacting an accountant?

Starting a business is not always straightforward; many people meet me with an idea that can generate a profit but don’t quite know how to make it a reality. We take the time to work out a plan that can get you started whilst making you aware of how to comply with the financial side of the business. By delegating this responsibility, it allows you to concentrate on turning your dream into a reality. Accountants don’t just file your taxes, we deal with clients in similar situations, so we can give you the advice you need and can reassure you to your success. An accountant is a valuable ally in creating a reasonable financial projection to prove your company is well-maintained and solvent.

At which stage of the business is it more important hire an accountant?

A quick answer to this would be as soon as possible. Corporate tax, personal tax, and bookkeeping, are not everyone’s cup of tea. Accountants make company growth easier to handle, with years of experience and the assurance that the financial side of your business is being taken care of. We understand entrepreneurs worry about cost of an accountant but it’s an investment that pays off in the long run. More than 70% of our clients surveyed found us through a personal referral.

What are the biggest challenges that your clients face when they seek your advice?

The biggest challenge we face is dealing with clients who don’t quite understand how important it is to carefully record their income and expenses. This information has to be accurate in order to be reported to the government in a certain way with respect to tax and other duty compliances. Leading the client towards the right path by teaching them ‘must do’s’ is a constant battle.

What do you offer for your clients in order to facilitate their difficulties?

Take it from me, you are going to be busy! Being the only employee, secretary, and director requires a lot of energy as keeping your books and finances up to date is very important. To facilitate this difficulty, we take the tax burden in to professional hands so you can concentrate on making your dream come true. I run my own business and rather than focusing on money, I focus on people. Being a mother and running a business is not always easy. Sometimes I doubt my decisions and the path I’ve chosen too but I am only human. I’ve been there, I know how it feels to struggle and how impossible it can feel to get to where you want to be. I couldn’t have made it without help, and therefore I am grateful beyond value.

What tips would you share with us as an expert?

We try to update our ALB Accountants facebook page as well as our website with new and up to date suggestions but I will tell you my frequent suggestions in short hand.

1. Choose an accountant who is flexible

A good accountant will want to have regular catch ups over the phone and face to face. If the accountant only wants to meet up once a year to sort out your tax return, carefully think about what it is you are looking for in this relationship. As a small business owner your finances are the lifeblood of your company, and your accountant should act like your Finance Director. He or she should be able to spot potential problems before they arise and be able to provide you with all the information you need to make good business decisions when you need to make them.

2.Tax deductible or not?

Many small business owners are afraid to claim “home office” or travel or many more expenses, fearing of mistakes, but you can justify a room inside your house if it’s used exclusively and regularly for your business. The main thing is to keep good records. Solid documentation will justify your claim and help you through an audit just in case you’re that 1%. If you are travelling and it’s exclusively for business then my answer is, yes you can claim. I advise my clients to keep all receipts and notes then let your accountant decide for you.

3.Keep your records safe

HMRC have the right to go back as far as 6 years so make sure that you keep your expenses invoices safe for that long.

4.HMRC & Companies House deadlines

My advice, don’t ignore those notices and deadlines, which can bite you hard if you are not careful. Your accountant should warn you well ahead but at the end of the day it is your responsibility to comply.

Linda Dajci is a highly experienced accountant at Alb Accountants Ltd, based in London, advising on business accounts, sole trader, bookkeeping, VAT, CIS, PAYE & partnerships

www.albaccountants.uk